It happens all the time, and you’re often the last to know. Your sponsor, once your economic buyer and advocate, is on the move. Gone. Losing an executive sponsor or senior point of contact is a catalyst for churn. Often “Executive Change” is reported as unavoidable churn. But is it?

Here’s How It Happens

Surviving an executive change is possible - even likely

Surviving an executive change is more realistic if you have a plan. Winging it and leaving a save to chance is not a winning solution. Your plan needs to start well before you receive news that your sponsor has departed. Ideally, you need to start by understanding your customers’ organizational structure and power chain. You need to understand how decisions get made. Post-sale teams should continually blueprint accounts looking for additional executive-level advocates. Also, risk is mitigated when you leverage your champion to create co-champions that will advocate for you when there is a shake up. A good rule is to create and foster at least three key advocates within each customer account. Ideally, these stakeholders should be cross-functional representing finance, IT, and functional teams.

Even when you do have a process in place to address loss of sponsor, the news is often blindsiding. More likely than not, executives don’t share their transition plans with anyone outside their org with advance warning. Otherwise, signals of change are often unconsciously ignored due to the sheer volume of communications your team is dealing with. Worse yet, what if requests like our example above land with a teammate that simply responds with a copy of the contract unaware of the gravity of the situation?

If your heart is racing and your palms are sweaty, you’re not alone. We’ve been there. That is why one of the first language models that we developed and trained when we started Sturdy was executive change.

Detecting customer Signals

So how do you detect executive change signals? There are some hacks out there. The easiest to implement is one that leverages LinkedIn Sales Navigator. If you have a paid account, set up “Career Change” alerts in LISN. This will work for smaller companies with 20-50 customers but gets too noisy at any kind of scale. The big constraint is that you can't filter the alert by decision makers only. This would be a good feature for LISN though by the time your DM updates their profile with a new role, the window of opportunity to save the account likely will have closed.

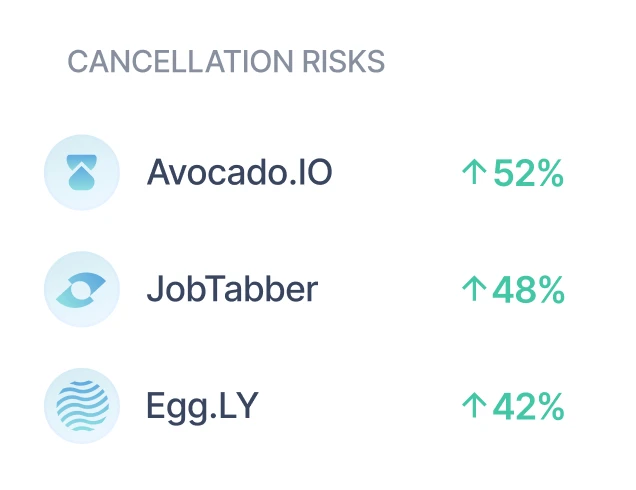

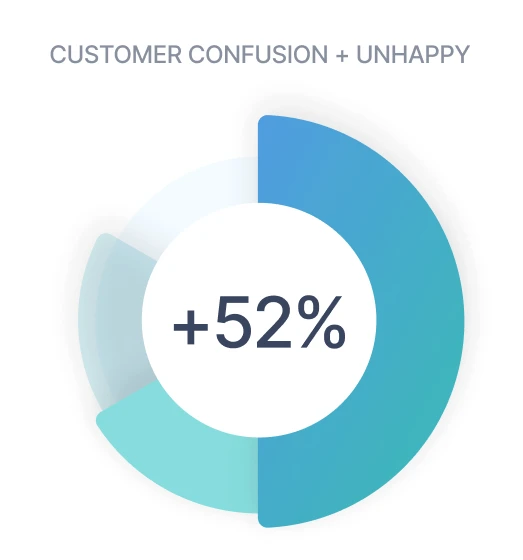

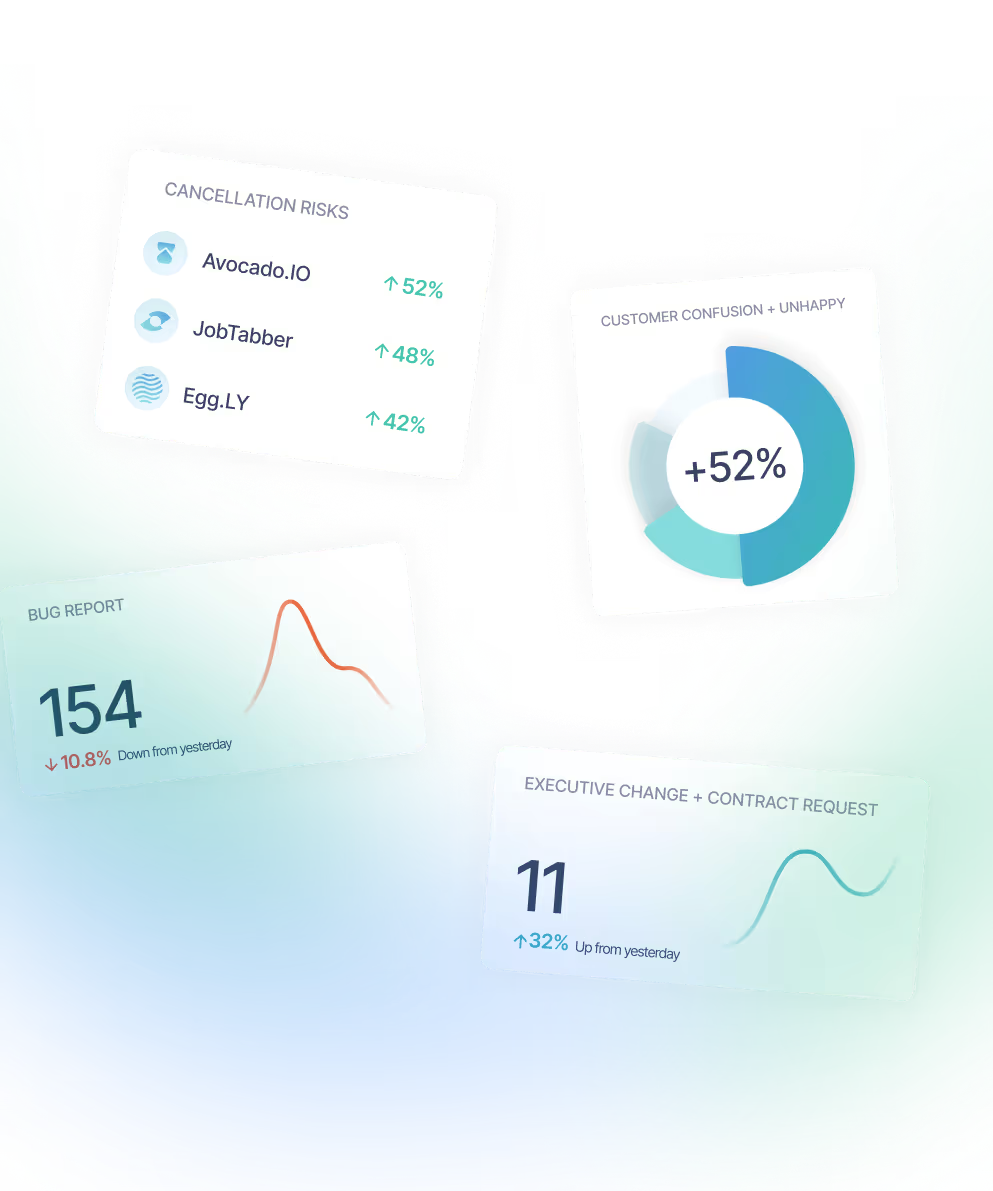

At Sturdy, we use our own product to detect executive change signals. Sturdy analyzes emails, tickets, chats, and video calls listening for signals of executive change. When it detects language synonymous with the loss of a sponsor, it flags the conversations and alerts our stakeholders immediately. Our alerts are sent to a Slack channel called #executive-change. At our stage, this is quite effective and still manageable. Eventually, we’ll connect Sturdy to our case management tool creating a more sophisticated closed-loop process.

Below is the same message from the top of this post but this one was run through the Sturdy AI Inference Engine. It’s been accurately flagged with customer signals indicating executive change and a high probability of churn. This message triggered a real time alert to our customer operations team.

Reacting to an executive change

We think about signals as lead generation for inquiry and action. And, as with sales leads, acting with urgency yields the best outcomes. Borrowing from our sales / marketing SLA, our requirement is to follow up on executive change signals inside of 1 hour. This makes us seven times more likely to schedule a meeting with the customer in the same week as the signal was received. Having a set timeline, we prevent procrastination and promote action.

Otherwise, we have a defined play that we run. The play has 3 phases and we train our workmates on this and other plans on an on-going basis. Here is an outline from our post-sales playbook for executive change.

The loss of an executive sponsor is a red-level risk event. Winging it doesn’t save customers. You need a defined process in place to mitigate account churn and solution downgrades. Team members need to investigate the account vitals quickly. Information should be gathered from other client stakeholders. If a new sponsor is in place, a briefing should be scheduled ASAP. Show the new leader what’s in it for them. Clearly emphasize the value your solution delivers. Minimize their risk. Show them the future. Give them an easy win.

A reminder of why it matters

The B2B SaaS industry is maturing quickly. Competition is fierce. Category leading post-sale teams focused on customer retention and monetization are building capabilities to significantly contribute to top line growth. For example, A $100M ARR Company with 2000 customers saves 30 customers in Year 1, dropping its churn from 8 to 6.5%. By maintaining this churn rate, its revenue in year 1 will be $1.6m higher. By year 5, $25m, and by year 10 almost $170m higher (50k ACV, 5% upgrade rate, 30% growth rate). Look at these numbers through an investor’s lens where some companies are valued at 25x earnings. Those are some real numbers. Saving a couple dozen customers a year really adds up.

Summary

The loss of an executive sponsor is a red-level risk event but it doesn’t need to be fatal.

- Preventative measures like fostering multiple executive-level relationships to develop cross functional advocates significantly mitigates risks. Go wider. Go cross-functional. Have no less than three key executive contacts at every account.

- Building a process or deploying technology to detect risk is key. Knowing is more than half the battle in this instance.

- Creating a defined process to manage a loss of sponsor event is imperative as is training team members to respond with urgency.

- Creating a culture that reinforces the importance of retention and customer monetization is a key to motivating high performance post-sales teams.

.png)

.png)

.png)