When I started my first SaaS company, I had a standing meeting on my calendars every week to read random support tickets (random is the crucial word, by the way). Reading tickets was always illuminating and often painful. One of our learnings was a churn risk called "New Sheriff."

First, don't get me wrong, we trusted our team. But if there's one thing that always bothered me, I never really knew what our customers said about us. And, for that matter, what we were saying to them.

Eventually, we built a suite of search strings, and if you want to try some yourself, here are a few simple ones:

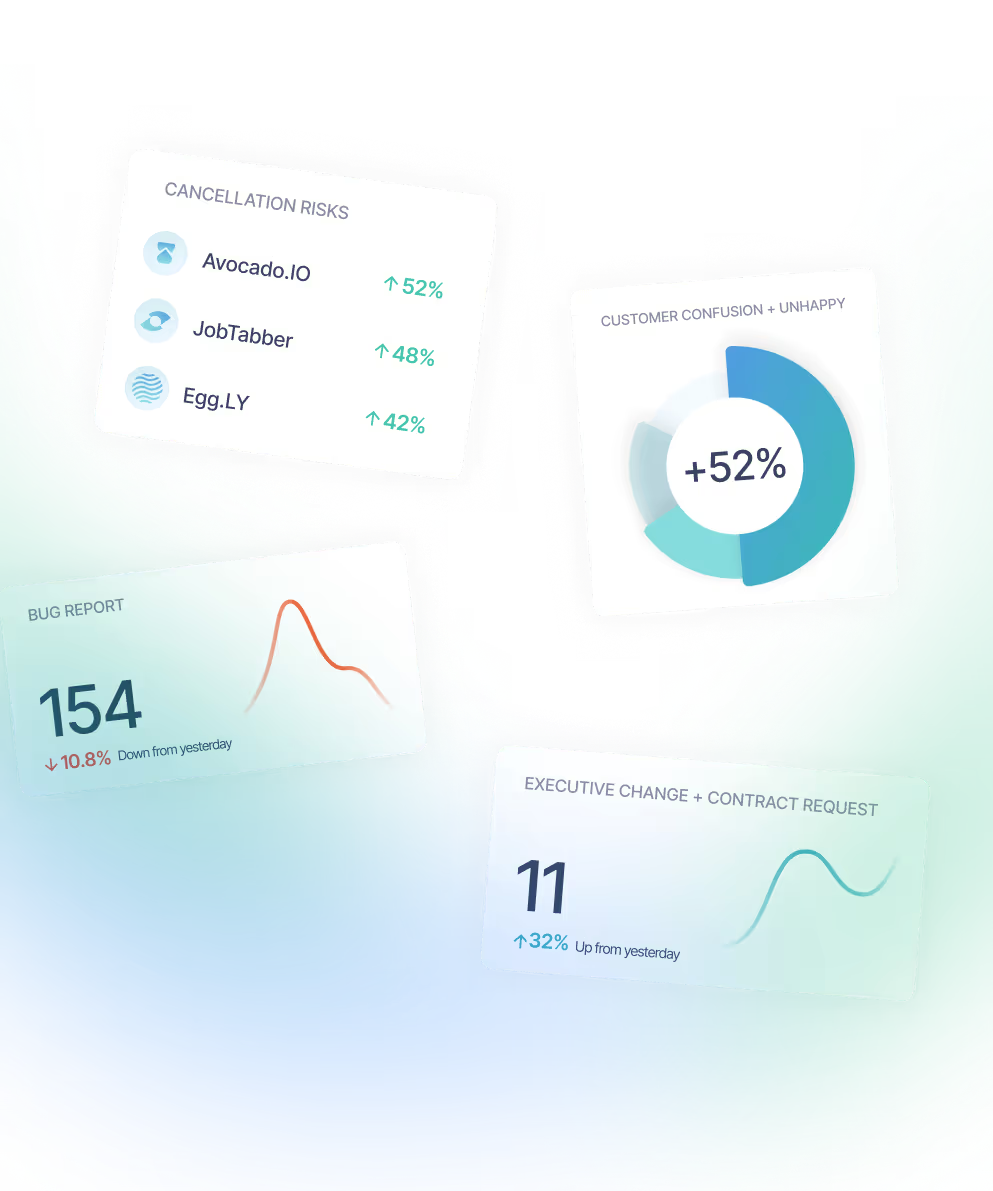

We would search for product issues with things like: "doesn't work"; "confusing"; "annoying" bug, and "clear cache."

Searching for things like "gotten back to me" and "still waiting" would indicate that our customer was still awaiting a response. I would look for revenue issues with: "new VP,"; "new vice president,"; "new manager,"; "has left the company,"; "copy of our contract,"; "renewal date," and "overdue."

You are probably thinking, "Why would I look for "new VP" or "new manager"?" It comes up like this, "Our HR Manager has left the company recently, and I need a login for our VP of HR, Jim Smith."

At Newton, HR executives were responsible for hiring/firing HR software decisions. We sold HR software.

A new HR executive was the highest indicator of churn in our business. By that, I mean, left unattended, our customer was almost certainly (80%+) going to churn at renewal. From this, the term "New Sheriff" was coined. A "New Sheriff" customer was no longer forecasted to be a long-term customer and thus needed to be resold.

We trained everyone at Newton on identifying a "New Sheriff" and where to send the alert - manually.

When we got a "New Sheriff" alert, several people got to work. The CS team would pull usage data and some other vital metrics. The account management team would reach out to identify the new VP and schedule a demo of our solution.

Our sales leadership would also reach out to the former executive. We'd offer to help them network to find a new job or make inroads at their new company.

In doing this, we turned our "churniest" event, one with an 80% churn rate, to one with a 30% churn rate (from -.8 to -.3). We also gained a lead for our sales team that closed 80% of the time (from 0 to +.8). In other words, we turned a very churny event into one that gained a half a customer.

If you'd like to capture "New Sheriffs," give me a shout, and I'll send you a few more advanced search strings. (If you’re a Sturdy customer, our models auto-flag this as “Executive Change.”)- Steve@sturdy.ai

.avif)

.png)